The State of Salesforce DevOps 2024 report is now live!

Thanks to the 1,296 Salesforce professionals who took part in this year’s survey, you can find out how teams from across the ecosystem are performing and how you can stay ahead of the curve in 2024.

The full report is packed with expert analysis and key benchmarking stats. Here’s a sneak peak at some key trends we’ve uncovered...

DevOps adoption is rocketing

DevOps adoption is increasing year-on-year. Find out why, and how your team compares, in the report.

DevOps is being democratized

Although developers were typically the first in the ecosystem to adopt Salesforce DevOps, the tide has turned and admins are now increasingly involved in DevOps processes; only 21% of teams are splitting their release workflows.

In the report, you’ll find out:

- The impact on Salesforce ROI of democratizing DevOps

- Which metadata types teams are struggling to incorporate into their DevOps release processes

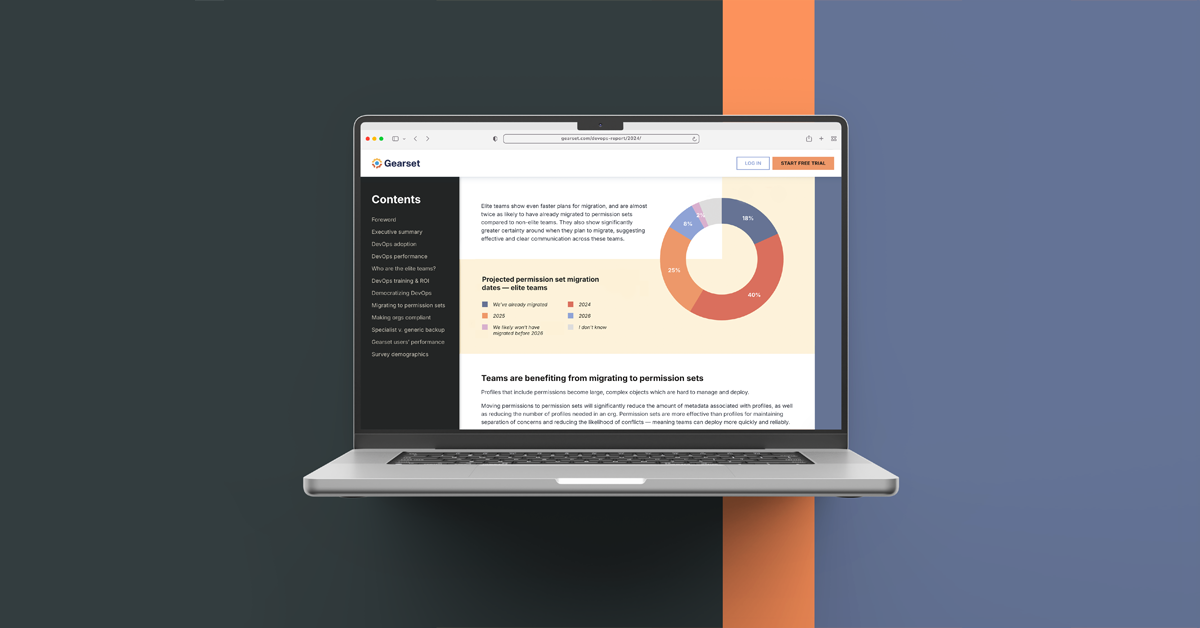

Migrating to permission sets is still a priority

Salesforce wants everyone to move from permissions on profiles to permission sets. Although it has deferred an official deadline, teams should still plan to migrate. Thankfully, the vast majority of teams already have a plan in place.

The report reveals:

- When people plan to complete their migration

- Which teams are migrating the soonest

- How migrating to permission sets impacts release performance

Compliance requirements are on the rise

Last year’s report highlighted that teams are bringing more business processes onto their Salesforce orgs. As orgs have expanded and house more data, teams need to comply with a broader array of compliance frameworks. A huge 82% are already compliant with at least one security framework and over half are working towards additional frameworks in the coming year.

Read more to uncover:

- How often teams experience issues at audit because of their Salesforce orgs

- What tools and processes help teams keep their orgs compliant

Some backup solutions are leaving teams vulnerable

Most teams now realize the importance of backing up their Salesforce orgs, with only 13% saying they don’t have plans to back up their Salesforce data. But, of those who do have backups in place, there are big disparities between the frequency of backup runs and the speed of recovery.

What else you’ll find out in the report:

- Which solutions enable teams to back up their data the most frequently

- The average restoration times for the different backup solutions

- Which teams are experiencing data loss most regularly

Keen to keep reading?

To find out how your team compares to others in the ecosystem and get access to expert analysis, read the full report for free.